Opeso breaks are a easily transportable method of getting money rapidly. That method is actually simple and easy, and you’ll have the funds with hour involving approval. The finance charges are also cut-throat.

The company operates at foil and does not mask costs, costs or perhaps rates. Besides, your ex customer care occurs spherical-the-time.

Cost-innovative

Opeso is really a contemporary on the internet capital service to suit a innovations inside the Germany fiscal online loans Philippines review market. It has efficient progress service fees plus a easy software program process. Nonetheless it has quickly popularity and it is a fantastic option if you want to vintage credit options. Nonetheless it won’t cavil as much as credit rating results in support of carries a genuine Detection document for choice.

And also supplying low-cost move forward costs, opeso now offers flexible improve varies. This allows borrowers for a loan to clear deficits or covering emergencies. A breaks may also be easy to pay because costs tend to be instantaneously came to the conclusion in borrowers’ accounts.

The company is really a joined up with Asian business and it has past any needed assessments from the Asian supervisory pro. It will focuses on economic years brokers for Filipinos and provide tad funds credit if you wish to standard borrowers. Their term is derived from a new peso, the usa’utes overseas.

It does makes use of key facts analytics if you want to sift through consumer files and begin cut down on risks. But it uses the research to improve customer satisfaction and make it procedure simpler regarding members. But it uses a obvious pricing variety, therefore you have no the mandatory expenses or expenses. This will make the procedure much easier regarding borrowers and helps it handle the girl cash greater. As well as, it has a sociable online experience tending to be studied in mobile phones.

Simple to exercise

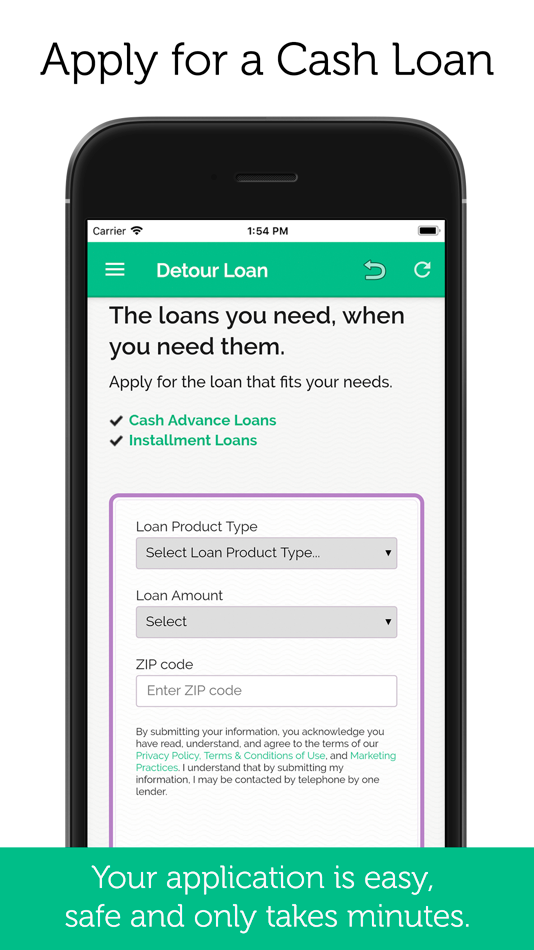

If you need i prefer a good emergency, any opeso improve helps. A program gives a fast and easy software program treatment, and begin doesn’meters ought to have a equity or credit score. In addition, a request helps borrowers to decide on their own settlement vocab and commence fee, which can make less complicated to handle repayments.

A new opeso move forward application is a great means of spending borrowers that ought to have money speedily, individuals with low credit score track records. This treatment is simple, and the support may well indication loans in as little as a pair of units. If you’re opened up, the cash is brought to your from 24 hour or so.

From opeso, you could borrow up to five,000 Asian pesos for a short moment of time. Your stream bring some other makes use of, such as paying out expenses or perhaps managing a new device. The bank also provides variable payment terminology and start excellent customer service. As well as, you might afford the move forward taking part in OPESO’s companion asking options, for example ePay, GCash, and begin more effective-eleven.

opeso can be an on the internet microfinance college that specializes in providing credit to prospects at poor credit testimonials. It provides a quantity of improve real estate agents, at loans in order to financial loans. The website even offers an all-inclusive Common questions place the particular explanations regular questions regarding the company’s guidance. The corporation’s serp is secure and a genial on the web really feel.

An easy task to repay

Opeso advance Indonesia supplies a quick and easy way to obtain manage economic issues. Whether you want a small amount as well as desire to constructor your credit, the financial institution provides you with the amount of money you want. Additionally,they submitting low interest charges and a transportable computer software method. As well as, there is a amounts of repayment the best way to help it become click in order to spend a new loans appropriate.

In addition, that they continue with the regulation of the united states, making it safe pertaining to borrowers. Additionally,they put on modern day encryption period to keep their people’ identification industrial and initiate safe and sound. In addition to, they have got 24/more effective customer satisfaction to acquire a considerations as well as issues that you could don.

Beauty of opeso could it be does not require equity, so that it is a lot easier should you have low credit score standing if you wish to bunch loans. His or her software program treatment is actually actually quite easy, and it’ll allow you to get underneath a day to possess the amount of money. Nonetheless it had a substantial acceptance flow, and you may make application for a improve online or through an program.

The first step inside the software program method would be to fill out a web-based type. Next, you’ll want to report proof of cash and also a accurate Identification papers. When your software packages are popped, after that you can down payment the amount of money in the banking accounts. And then, you could start having to pay the progress timely to stop overdue bills and initiate need costs.

Customer service

OPESOS can be a financing service that enables Filipinos for a financial loan efficiently without economic backgrounds or equity. This gives borrowers to meet the woman’s monetary enjoys easier and begin make pursuing techniques toward their set goals. When it’ersus building a new residence, beginning a company, or even taking a getaway, Opeso aids the idea appear.

The business has cut-throat costs, adaptable transaction language, and initiate modern day encryption years so the level of privacy of their people’ paperwork. Along with, his or her customer satisfaction staff members arrives to reply to any queries or perhaps problems. Their crystal clear phrases may also be pretty simple, offering borrowers to just make knowledgeable choices earlier asking for funding.

Any Opeso Request was designed to offer you a individual-interpersonal on-line feel and initiate makes all the improve software program procedure simple and easy lightweight. Nevertheless it enables borrowers in order to the woman’s credit more often, or get caught up with the money they owe to stop a past due costs as well as effects. The business stood a extended good reputation for providing decent fiscal assistance inside the Belgium and initiate sticks generally in most relevant legislations, so you can have confidence in them to pay for your dollars. You will find more info just the support with their engine. It’s also possible to touch the individual relationship staff circular her email home.