The first type of inventory transaction you’d make would involve buying raw materials inventory, or the materials you use to make your products. You’ll have to have a basic understanding of the inventory cycle and double-entry accounting methods to make the proper entries. Take a look at the inventory journal entries you need to make when manufacturing a product using the inventory you purchased.

What is the Journal Entry for Inventory Write-Down?

Inventory can be expensive, especially if your business is prone to inventory loss, or inventory shrinkage. Inventory loss can occur if an item or product gets damaged, expires, or is stolen. Before we dive into accounting for inventory, let’s briefly recap what inventory is and how it works. The articles and research support materials available on this site are educational and are not intended to be investment or tax advice. All such information is provided solely for convenience purposes only and all users thereof should be guided accordingly.

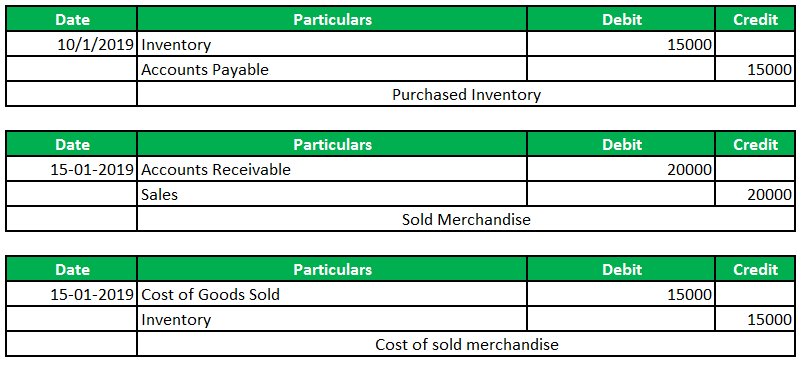

Inventory Accounting Journal Entries

In the double-entry accounting method inventory purchased on credit is also recorded as accounts payable, or your short-term financial obligation to pay your supplier. Perpetual and periodic inventory accounting methods are two practices used to account for inventory transactions. In this guide, we break down the different accounting methods used in product businesses and list 13 of the most important inventory accounting journal entries you need to know.

Raw materials

- It ensures that inventory balances are correct and that the cost of goods sold (COGS) is accurately reported.

- It’s important to identify any indirect production cost, allowing you to create a complete budget that includes all the expenses related to your inventory.

- Adjustments are made based on the differences between the physical counts and the recorded inventory levels.

Likewise, the inventory sale journal entry will be different if one company follows the perpetual system while another company follows the periodic system. When you sell the $100 product for cash, you would record a bookkeeping entry for a cash transaction and credit the sales revenue account for the sale. This transaction transfers the $100 from expenses to revenue, which finishes the inventory bookkeeping process for the item. An interesting point about inventory journal entries is that they are rarely intended to be reversing entries (that is, which automatically reverse themselves in the next accounting period).

This method smooths out price fluctuations over the accounting period by averaging the cost of beginning inventory and purchases. The weighted average cost per unit is then applied to both COGS and ending inventory. This method is straightforward and provides a moderate impact on financial statements, neither inflating nor deflating profits significantly during price changes. You can record this transaction by transferring the cost of the finished goods sold to the expense account for the cost of goods sold. This moves the cost of inventory from where it’s recorded as an asset on your balance sheet, to your income statement, where it is recorded as an expense.

By following the steps and best practices outlined in this article, businesses can ensure that their inventory accounts are accurately adjusted, supporting reliable financial reporting and informed decision-making. Ongoing education, training, and consultation with accounting professionals further enhance the effectiveness of inventory management practices, contributing to the long-term success of the business. A perpetual inventory system continuously updates inventory records with each purchase and sale transaction. This system provides real-time inventory data, reducing the need for frequent physical counts. However, periodic physical counts are still necessary to verify the accuracy of the records and to adjust for any discrepancies caused by theft, damage, or errors. The perpetual system is more accurate and efficient but requires robust inventory management software.

Although there is an increase in accounts payable or cash out here, the cost has not occurred yet. In this journal entry, there is no purchase account and the amount of purchase directly goes to the inventory account by adding to the inventory balances. This way the company can view the inventory balances after posting the purchase journal entry (or at any time). By following these steps, you can create an accurate inventory journal entry book value per share bvps overview formula example to reflect the transaction and maintain accurate accounting records. By providing these detailed examples of adjusting journal entries for different scenarios, businesses can better understand how to properly account for discrepancies, losses, and special inventory situations. Accurate adjustments ensure that financial statements reflect the true value of inventory, supporting reliable financial reporting and informed decision-making.

This increases the inventory, reflecting the addition of landscaping materials. This decreases the cash balance, indicating money paid out for the purchase. Therefore, even if the market value exceeds the cost, the “gain” is not recognized until a sale occurs, such as after an acquisition. This is the reason that one formula does not fit all inventories and business types.